Daily Market Analysis and Forex News

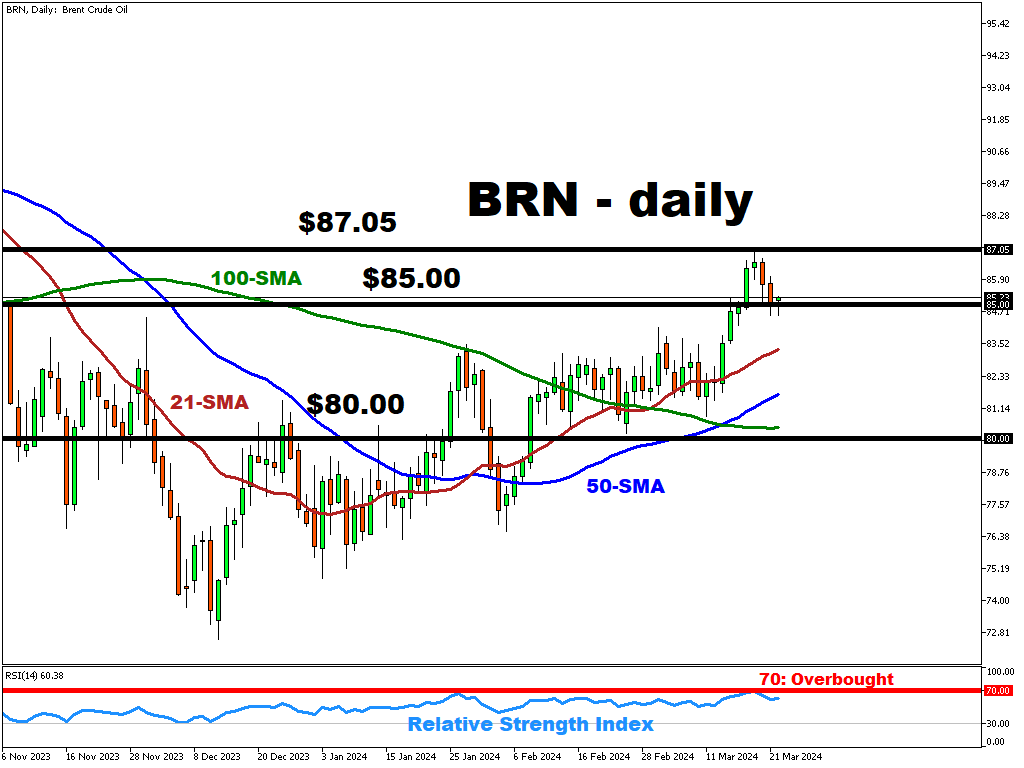

BRN has slightly rebounded, trading above $85/bbl

Brent prices are hovering around $85/bbl after a volatile period accompanied by Fed’s commentary and geopolitical developments in the Middle East.

US’ stockpiles data showed an unexpected decline, indicating a potentially strong demand for fuel.

The Federal Reserve’s decision to potentially keep the interest rates higher for longer could slow down economic growth, thus reducing future demand for oil.

A disruption of a number of Russian oil production plants along with potential extension of the OPEC production cuts may significantly affect supply and induce a significant upward pressure on oil prices.

Despite the short-term bullish outlook for black gold due to inventory drawdowns and supply concerns, factors like Fed interest rate policy and Chinese import could potentially cause price swings.

On the technical side …

- Brent is trading above the 21, 50 and 100-period simple moving averages (SMAs), highlighting a potential for bullish momentum

- The relative strength index (RSI) is positioned at 59.66 – well below the upper boundary (>70 – overbought; <30 – oversold). This potentially underscores the market’s state of uncertainty as investors await for more catalysts to act upon

- To the downside the key support level is located at $85/bbl round number, while to the upside the $87.05/bbl (this week’s high) may act as a key resistance/target for the BRN bulls

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.