- Forex

Trading conditions Deposits and withdrawals

Alpari Mobile MetaTrader 4 MetaTrader 5

- Investments

Ratings PAMM service Investment conditions

PAMM portfolio constructor Alpari Invest

- Loyalty program

- Promotions

Special offers and bonuses

The Refer a Friend program

- Analysis

Market reviews Forex economic calendar Analytical tools

Currency converter Alpari Mobile

- Getting started

Articles about Forex Glossary

Demo account

- About us

Company news Service Quality - Help Centre

- Raise Request

Partnership programs Sponsorships Social responsibility

- Forex

Trading conditions Deposits and withdrawals

Alpari Mobile MetaTrader 4 MetaTrader 5

- Investments

Ratings PAMM service Investment conditions

PAMM portfolio constructor Alpari Invest

- Loyalty program

- Promotions

Special offers and bonuses

The Refer a Friend program

- Analysis

Market reviews Forex economic calendar Analytical tools

Currency converter Alpari Mobile

- Getting started

Articles about Forex Glossary

Demo account

- About us

Company news Service Quality - Help Centre

- Raise Request

Partnership programs Sponsorships Social responsibility

- Home page

- Investments

- Ratings

PAMM account ratings

- 25

- 50

- 75

Help

Alpari’s ratings provide a great way of finding accounts to invest in. Our wealth of experience has allowed us to develop a complex PAMM account rating system designed as a convenient tool to help investors choose a manager. While the manager's returns are of course a key factor, the associated risk is another that should not be overlooked. Alpari's ratings strike a balance between the two, providing the key to success in investing.

Alpari currently has two ratings, as there are two separate principles by which we determine an account’s Effectiveness rating. There’s the Dynamic rating, for which a new method of sorting has been developed, and the Conservative rating, for which the sorting method is the same as before. All public PAMM accounts are featured in each of the ratings.

Dynamic rating

1. Determining an account’s place in the Dynamic rating

The rating is made up of two blocks, with PAMM accounts falling into one or another depending on their “Effectiveness” rating:

- The first block is made up of accounts with a positive return and are open for investment with a public proposal.

- The second block is made up of all remaining PAMM accounts.

Please note that PAMM accounts with negative returns and with closed public proposals cannot appear in the TOP rating.

2. PAMM account Effectiveness rating in the Dynamic rating

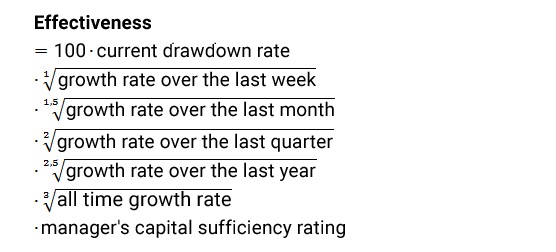

The formula for calculating an account’s Effectiveness in the Dynamic rating is as follows:

This is the ratio of the current share price to the share price’s all-time high.

For example, if the share price’s all-time high is 12,000 USD and the current share price is 9,000 USD, we get 9,000/12,000 = 0.75.

Moreover, the value for current drawdown (expressed as a percentage) can be found in the full list of accounts. By using this, you can calculate the current drawdown rate as follows:

Current drawdown rate = 1 – Current drawdown / 100.

Growth rate over the selected time periodThis indicator is used to exclude accounts from the top of the ratings that have overcome significant drawdown, and therefore have high return rates over shorter, more recent time periods.

The growth rate is calculated using the highest closing price of all time on the return chart (Qmax) before the beginning of the selected time period, and the current price (Qnow).

Formula: MAX (1; Qnow / Qmax).

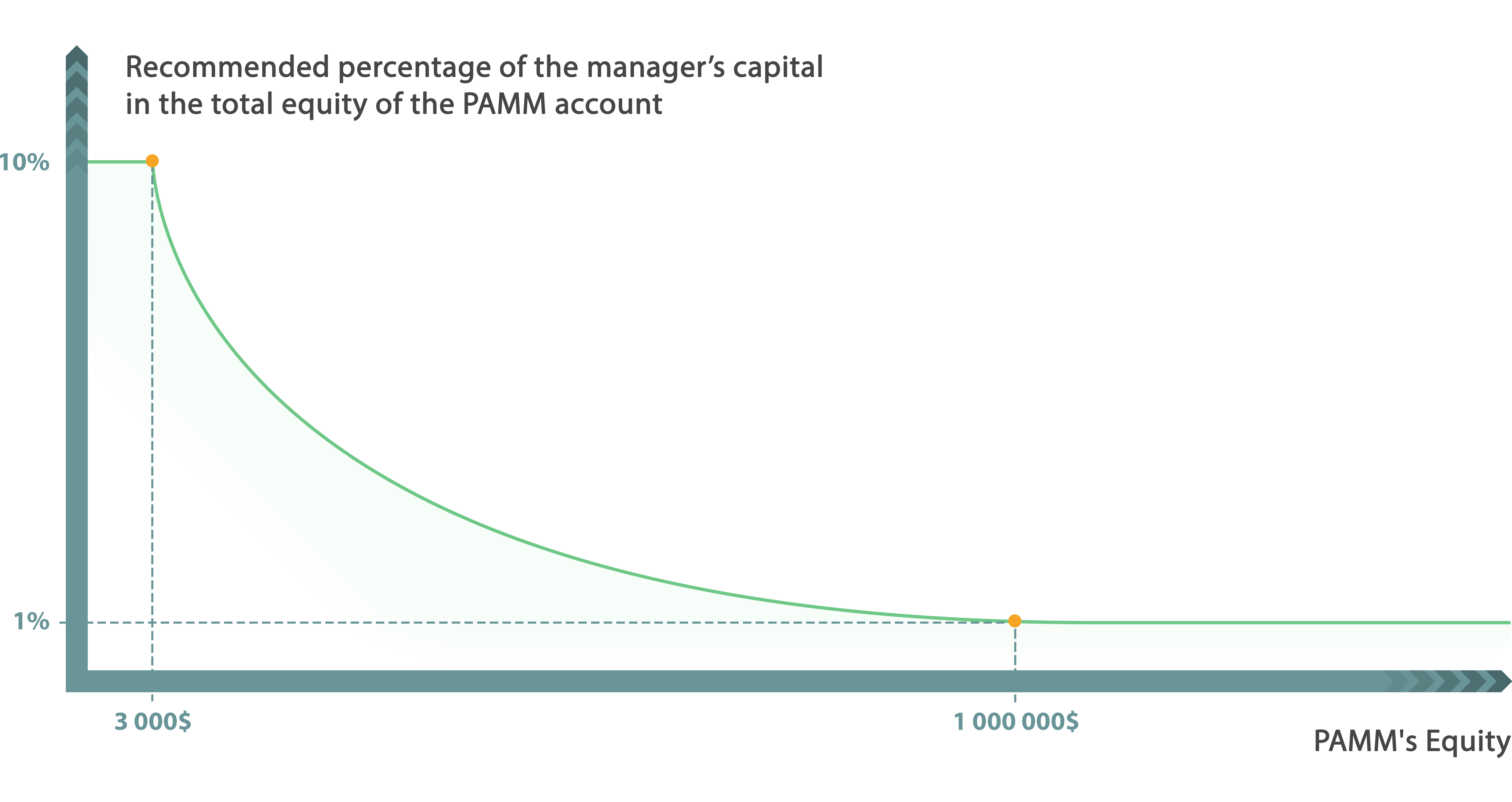

Manager’s capital sufficiency ratingThe capital’s sufficiency is determined on the basis of the percentage of the manager’s capital in relation to the total equity on the PAMM account.

3 000 USD — 10%

1 000 000 USD — 1%

All intermediate values must be above this curve (the Manager’s Capital Sufficiency Curve):

The formulas required for calculating the recommended level of manager’s capital are presented below in MS Excel format.

The calculation of the Manager’s Capital Sufficiency Curve uses a logarithm with the following base:

log_base – LEVEL(1,000,000/3,000; 1/(1-10))

RecommendedPercentage = MAX(1;MIN(10;LOG(PammEquityInDollars/3,000; log_base)+10))

RecommendedCapital = ROUNDED(0.01*PammEquity*RecommendedPercentage; 0)

FulfilmentPercentageOfRecommendedCapital = 100 * Actual Capital / Recommended Capital

Manager’s Capital Sufficiency Rating = 0.5+0.5*MIN(100; FulfilmentPercentageOfRecommendedCapital)/100

Conservative rating

1. Determining an account’s place in the Conservative rating

The rating is made up of three blocks, into which PAMM accounts are sorted on the basis of their “Effectiveness” rating:

- The first block is made up of accounts that are at least 3 months old, have a positive return, are open for investment with a public proposal, and where the manager’s capital is at least 3,000 USD / EUR.

- The second block is made up of PAMM accounts on which trading operations have been made.

- The third block is made up of PAMM accounts with no trading history (whose return is at 0%).

Please note that PAMM accounts from the 2nd and 3rd blocks cannot appear higher in the rating than accounts in the first block.

2. Determining the effectiveness of PAMM accounts in the Conservative rating

Determining the effectiveness of PAMM accounts employs a complicated formula developed by Alpari’s experts, which takes into account the wishes and suggestions of clients.

The following parameters are used in the formula:

- Return.

- Maximum leverage used.

- Recovery factor.

- Volatility.

- Age.

- Maximum drawdown.

- Effectiveness rating.

Loading, please wait...

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.