While many traders are focused on becoming profitable and increasing their trading account, one should also consider which are the best ways to file gains and losses with the taxing authorities. Forex brokers usually don’t handle taxes, so it remains the duty of traders to report and file their dues or deductions to the relevant tax authorities. Although over-the-counter trading is not registered with Commodities Futures Trading Commission (CFTC), beating the system is not advisable as government authorities may catch up and impose huge tax avoidance fees, overshadowing any taxes you owed. It’s also worth noting that tax regulations do evolve and change over time, which means you need to be up-to-date with all the changes.

The best way to handle the complex task of tax calculations is to consult a professional tax professional, who will help you out with any questions you may have and advise on the most favorable tax laws for your individual situation. In addition, the notes in this article are predominantly based on US tax laws and for informational purposes only, so make sure to understand that tax regulations may vary from country to country.

How are Forex traders taxed in the US?

Forex traders in the US who trade with a US broker have two options available to file their taxes. The two sections of the tax code relevant to US traders are Section 988 and Section 1256. Both sections were initially applied to forward contracts, but nowadays they’re also relevant to retail Forex traders. In the case of a very large trading account that experiences losses more than $2 million in a tax year, traders may qualify for other tax treatments than the one mentioned.

Let’s take a look at the requirements of both sections:

Section 988

Section 988 covers Over-the-Counter (OTC) investors, such as retail Forex traders, and was instituted by the Tax Reform Act in 1986. This section taxes Forex gains like ordinary income, which usually means a higher rate than the capital gain tax. Section 988 is also relevant for retail Forex traders. It states that investors who incur capital losses have the ability to deduce the losses from the income tax. A capital loss occurs in a situation where you sell an asset for a lower price than what you paid for it - as in a losing trade for example. On the contrary, capital gains occur when you sell an asset for a profit, i.e. at a higher price than its initial price, as in a winning trade. If your capital gains exceed your capital losses, you have a net capital gain. Similarly, if your capital losses exceed your capital gains, you’re in a net capital loss position. Section 988 allows you to match your net capital losses with other sources of income and clam them as a tax deduction.

Section 1256

By US law, Forex traders can also choose to be taxed under the provisions of Section 1256 instead of Section 988. Let’s take a look at the provision of Section 1256.

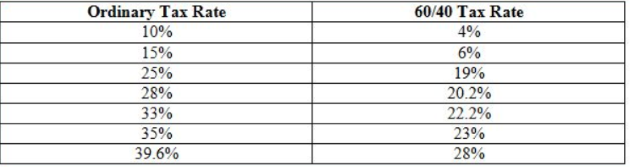

Section 1256 is based on the classic “60/40” rule of net capital gains taxation. This means, that 60% of your net capital gains fall under the LTCG (long-term capital gains rate), and the remaining 40% under the STCG (short-term capital gain). The LTCG rate is usually around 15%, while the STCG rate depends on your individual position and income rate, and is usually around 35%. The following table compares the amount of an ordinary tax rate with the calculated rate of the 60/40 rule. The tax rates are considerably lower using the 60/40 rule.

However, Section 1256 limits the amount of capital losses that you’re able to claim as a tax deduction to the amount of capital gains for the period. Essentially, if you’re experiencing a net capital loss, you should file your losses under the provisions of Section 988. But if you’re profitable for the period and experience net capital gains, you’d be better off under the provision of Section 1256.

In addition, all traders in Forex options and Forex futures file their dues under Section 1256.

Some benefits of the tax treatment under Section 1256 include:

Time: intraday and short-term trading is very popular among Forex traders. Despite the short-term nature of these trades, 60% of them can still be treated as long-term capital gains/losses with a lowered tax rate.

Tax rate: Forex futures and options traders, just like retail Forex traders, can tax their gains under the 60/40 rule, with 60% of gains taxed with a maximum rate of 15%, and 40% of gains taxed with a maximum rate of 35%.

Section 988 vs. Section 1256

Section 988 taxes losses more favorable than Section 1256, making it a better solution for traders who experience net capital losses. While under Section 988 the tax rate remains the same for both gains and losses, Section 1256 offers 12% more savings for traders with net capital gains (60% x 15% + 40% x 35% = 23%, compared to the 35% tax rate under Section 988).

As you can see from the calculation above, if you have a net gain of $2,000, the amount of tax payable under Section 988 is $700, at a maximum income tax rate of 35%. Compare this with Section 1256, where the tax amounts to $460. The total tax savings with Section 1256 amount to $240. Remember, if you had a net loss instead of a gain, you’d be better off with Section 988.

How to calculate your performance record for tax purposes?

The most accurate way to calculate your profit/loss and make tax filing easier is through a performance record. And unlike your broker’s trading statements, a performance record may also lead to a lower tax basis. To calculate your performance record, you need to:

- Calculate your net gain/loss by subtracting your beginning balance with your ending balance

- Add withdrawals from your account and subtract deposits to your account

- Add rollover charges (interest paid) and subtract rollover income (interest income)

- Add other trading expenses, such as trading commissions

Keeping a performance record and detailed booking of your trading performance can make tax filing a lot easier by yearend.

How to change your tax status?

Although the US tax system separates Forex futures and options traders from spot traders, each trader can decide whether to elect Section 988 or Section 1256 as their tax treatment. Generally, spot traders trade with the intention to have a net capital gain, and decide to opt out of the default Section 988 status and switch to Section 1256 which has lower rates for net gains. To do so, traders need to make an internal note in their books and file the change with their accountant. Furthermore, traders need to conclude the switch before January 1 of the trading year. Eventually, you can change your status by another date upon IRS approval.

How are UK Forex traders taxed?

The United Kingdom approaches the taxing of Forex traders in a different manner than the United States. In essence, spread betting is not taxable under UK tax laws, and many UK-based Forex brokers arrange their business around spread betting. This means, profits made by UK traders are essentially tax-free. As a downside, UK traders don’t have the ability to use their trading losses as a basis for tax deductions of other income.

Conclusion

Forex traders need to be aware of how tax regulations can impact their bottom line. According to the IRS, Forex options and futures traders, as well as spot Forex traders, need to file their capital gains under either Section 988 or Section 1256. The latter of the two was first intended for options and futures traders, but spot FX traders can change their status from Section 988 to Section 1256 as well. Generally, Section 988 is more favourable when it comes to net capital losses as they can be used for tax deductions of other sources of income. On the other hand, Section 1256 has a relatively lower tax rate on capital gains due to its 60/40 law, which taxes 60% of gains at a maximum rate of 15%, and the remaining 40% at a maximum rate of 35%.

Traders should ideally pick their Section before their first trade and before January 1 of the trading year, although future changes are also allowed with IRS approval. The safest bet is to consult a professional tax planner right away, as he or she is able to accurately answer all your questions. Furthermore, your accountant can also help you with the preparation of a performance record, which can be more favourable to your bottom line than your broker’s trading statements. Remember, tax filing is a complex task and if you have any doubts, please consult a tax professional.