There are many ways to trade the market. Some traders decide to practice on their own and analyse the market themselves, while other traders look for Forex signals to enter the market. Generally, to become a profitable Forex trader you’ll have to learn and trade on your own – this is the best path to follow for beginners on the market. However, Forex signals can also be used to deepen your knowledge about trading if the signals include some additional charts and supporting market commentary. In this article, we’ll show you what Forex signals are and guide you through the main characteristics of good Forex signal providers. We’ll also mention some of the main differences between paid and free Forex signals, and by the end of the article you’ll also know how to use free signals to improve your own trading! So, let’s get started.

What are Forex signals?

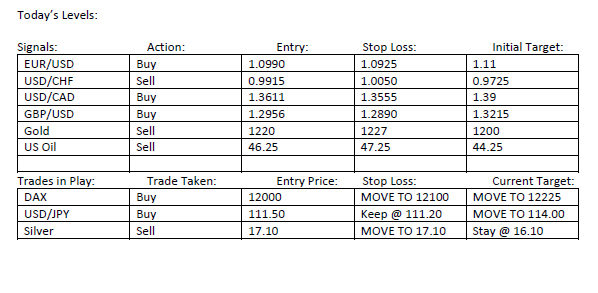

Forex signals are trading signals sent out by a signal provider, that include entry and exit prices ready to trade on. All you have to do is to manually enter the trade on the specified currency pair and at the specified price, enter the stop-loss and take-profit levels provided in the signal, and that’s it. Some examples of FX signals are shown below.

There are many Forex signal providers out there, and just like in any business, some of them offer paid subscriptions to receive the signals while others offer completely free signals and usually earn by advertising another product, such as a trading course or an upgraded signal membership. While we’ll focus on free Forex signals in this guide, there is essentially no real difference between paid and free signals – both include the traded currency pair, the entry price, and stop-loss and take-profit levels.

Here’s a checklist of what to look for in free live Forex trading signals. You may also have other considerations when choosing a signal provider, but these are the most crucial ones that quality Forex signals should have.

- Check the signal’s profitability and look for a track record

Naturally, the most important characteristic of live Forex trading signals is their profitability. Since I assume that you wouldn’t follow a signal provider who sends losing signals, Forex signals need to be consistently profitable in order to attract subscribers. Of course, there might a losing trade here and there, but on a weekly or monthly basis all signals combined should be able to generate a profit.

In order to check for the profitability of the signals, your best bet is to look for verified track records. Signal providers usually post them directly on their website, in the form of a link or chart from third-party verifiers like myfxbook.com. If the provider doesn’t showcase verified trading results, chances are that the signals are either (a) not profitable, or (b) the provider doesn’t put too much effort to highlight the profitability of his signals. In both cases, you would likely be better off looking for another Forex signal provider.

- Do the signals include supporting materials?

Some signal providers also include additional materials with the signals, such as charts and market commentary. This can be a nice touch if you want to learn along with the signals by analysing why a particular signal was sent out, what support and resistance levels the provider marked, and whether the provider includes fundamentals in the market commentary.

In any case, most traders would be reluctant to trade blindly on signals without additional background information from the provider, and supporting materials also show that the provider cares about a positive user experience. If you want to trade on the best free live Forex signals, make sure that they include additional materials such as charts and market commentary.

- Does the signal provider offer a trial period?

If a Forex signal provider charges for its services, we strongly advise you to sign up for a trial period first before becoming a subscriber. Most signal providers offer trial periods nowadays, usually ranging from one-week to one-month trials. If the provider doesn’t offer a trial period, there might be a possibility that they're hides something – in this case, check again for a verified track record on the provider’s website or directly send the provider an email asking for a free trial period. If the signals are profitable, there shouldn’t be a reason for the provider not to offer a trial period, as most customers will likely become paying subscribers if the trial period shows profitable.

The trial period can also be used to check whether the signals match your trading style and time zone. Are the signals based on short-term or long-term trading, are the trades actively managed by the provider, and when and how are the signals sent out? Let’s take a look at these questions in the following points.

- When and how are the signals sent out?

Besides the profitability of the signals, the time and the way the signals are sent out are also important to consider. After all, if you receive the signals early morning or late in the evening in your time zone and cannot trade on them, then there’s no real benefit to stay with the provider. Most of the providers state the common times of when the signals are sent out on their website, so you should do your research first before signing up. If the provider offers a trial period, this can also be a convenient way to check whether the provider covers your time zone.

In addition, check how the signals are sent out. The most common ways include instant messaging apps like Viber or WhatsApp, via email, and SMS. Make sure that you have the necessary technical requirements to receive the signals beforehand.

- Are the signals actively managed?

Another crucial point when choosing a Forex signal provider is whether the signals are actively managed. The provider should send signal updates if the signal becomes invalid on a change in market environment or risk sentiment, or if the trade should be closed before it the take-profit or stop-loss targets are hit. Actively managed trades tend to perform better than trades which are not managed at all, which is why Forex free signals live should be updated by the provider if the setup becomes invalid. The provider should also be able to explain why a trade was changed or why exit targets were moved to another level.

Of course, if trades are actively managed, this involves more work from your side to adjust the position according to the updated parameters. If the provider changes their mind too often and makes changes to all of the signals, this might be a sign that the provider is not confident in their analysis and you might want to think about looking for another one. Changing a few trades is fine, but changing the majority of sent-out signals obviously shows that something is wrong.

- How is the provider’s customer support?

While paid Forex signals should come with customer support as well, it might be too much to expect great customer support from their free counterparts. Even the best free live Forex signals have a lower-quality customer support compared to the paid ones. However, you should be able to contact the provider if you have any problems with the signals, including their delivery, performance, or anything else. Forex signal providers usually state their customer support information on their website and offer email and WhatsApp or Viber support. Paid Forex signals may also have a telephone hotline or live chat incorporated in the website.

Final words on free Forex trading signals

Forex signals are an alternative way to trade the Forex market, which may be convenient for inexperienced traders or traders who want to learn more about trading. For the latter to be possible, the Forex signal provider should offer additional materials sent out together with the signals, including but not limited to price charts and market commentary. Live Forex signals for free usually lack most of the support that paid signals offer, but nevertheless, even free signals should be profitable. In the end, why would someone follow free signals and lose money on them?

The active management of signals is also a hot topic. When trading conditions change and a setup becomes invalid, the provider should care to send an update of the signal and its parameters. Again, there is a difference between paid Forex signals & free signals live regarding the frequency of signal updates and active management.

Before subscribing to a signal provider, make sure that the signals match your time zone or you’ll likely miss out on most of the signals. If the provider offers a trial period, sign up for the trial first to check the performance and delivery of the signals before subscribing for the service. While learning how to trade by yourself will probably produce the best results in the long run, subscribing to free Forex trading signals today may also carry certain educational benefits – especially if the signals are accompanied with detailed charts and market commentary.