If you’re asking yourself how to start trading Forex, don’t look any further. There are many important points you need to know before you start trading Forex, such as picking a broker, installing your trading platform, and analysing the market. These are just the essentials of trading, and you’ll need to gain experience on your own through trial and error on the market. There are also a few handy tips that can improve your trading performance, especially if you’re new to trading and thinking about how to enter the Forex market. In this article, we’ll cover everything you need to know to get started as soon as possible and show you how to get into Forex trading, how to open your first trading account, and how to start trading Forex online.

How to start trading Forex

To start trading Forex, all you need is a computer with internet access, a brokerage account, and a trading platform. The computer you use should have enough power to run multiple programs simultaneously, as you will likely have numerous tabs open in your web browser while analysing the market. The trading platform also eats up part of your computing resources, especially if you have a lot of charts open.

The next thing you'll need to start trading on the Forex market is a brokerage account. It’s fairly simple to open an account with a Forex broker. Usually, all it takes is around two days for your application to be processed and your account to be ready for deposits. At this point, we need to add a few points which will guide you through your broker selection process:

- Regulation – One of the most important points when choosing a Forex broker is regulation. There are many Forex brokers available on the market to choose from, but not all are regulated. To find out whether your broker of choice is regulated, scroll down to the bottom of the broker’s homepage and check for the broker's credentials. All regulated brokers will have their regulatory body and licence available on their website, and you can also check with the corresponding regulatory authority on whether the broker is listed on the regulator’s website. Nevertheless, choosing a regulated broker has many advantages, as you can rest assured that industry standards are upheld and enforced, and that your deposits are protected.

- Transaction costs – The next important point is transaction costs. In Forex trading, you’ll pay fees whenever you place a new trade through a so-called spread. The spread is simply the difference between the Bid and Ask prices of a currency pair, and can be as low as 1 pip on major currency pairs. Fortunately, most Forex brokers have very tight spreads nowadays due to fierce competition between them.

- Customer support – Last but not least, you need to be sure that the broker provides some kind of customer support. Brokers that care about their clients will usually provide several ways to contact them, such as via telephone, email, live chat, or through an on-site contact form. Having a variety of ways to contact the broker ensures that all your issues and questions will be resolved in a timely fashion. Opening a demo account with your broker is also a smart move to check the broker’s trading platforms, tools, and price quotes.

Once you have chosen your broker, all you need to do is to fill out the registration form on the broker’s website and you’re all set. Once your application is processed, you’re ready to deposit funds into your trading account and place your first trade.

This leads us to the question of trading platforms. Your broker will list all available platforms on its website, and you’re free to download whichever you want. However, I strongly recommend starting with a third-party trading platform such as MetaTrader. This is arguably the most popular trading platform among retail Forex traders, with tons of features and charting tools to assist you in your market research. MetaTrader also has a large online community and hundreds of available add-ons to download for free.

How to invest in Forex

Once you’ve opened an account with your broker, you can then make a deposit to your trading account. Check with your broker the minimum deposit requirements and the accepted ways to fund your account. Usually, most brokers accept credit and debit cards, as well as online payment service providers, which is also the most secure and fastest way to top up your trading account. A credit/debit deposit usually takes no more than a few hours to be credited to your trading account.

At this point, you also need to consider the leverage you want to use in your trading. Leverage allows you to open a much larger position than your initial trading account would allow. To do so, your broker will lend you money and set aside a small part of your trading account balance as collateral for the loan. Most of the brokers offer leverage of 50:1, 100:1, or even more, with the ratio determining the maximum position size you’re allowed to open. For example, a 100:1 leverage allows you to open a position which is 100 times larger than your account balance. If you have a balance of $1,000 on your trading account, this would mean that you’re able to open a position of $100,000, which is equal to one trading lot in Forex terms. However, bear in mind that trading with high leverage could also blow your account in a matter of minutes, as leverage magnifies both your profits and losses.

Finally, if you don’t want or don’t have the time follow the market, and want to know how to invest in Forex without having to trade on your own, you can choose to invest your money into a managed account where a professional money manager will trade your funds. The manager will usually charge a performance fee, which is a fixed percentage of the profits that the manager generates. If there is no profit, most managers won’t change anything.

How to trade Forex from home

Once you’ve set and topped up your trading account, you're ready to trade Forex from home. Open the trading platform on your computer and look for tradeable opportunities on the market. Forex trading is a skill that, just like any other skill, takes time to develop. Start with smaller position sizes and increase them as you gain more and more experience on the market. Most retail traders start out by learning technical analysis, so let’s explain how this trading discipline works.

Technical analysis is based on analysing pure price charts for trading opportunities. There is no need to follow news and other fundamentals to perform technical analysis, which is one of the main reasons why beginners are attracted to this type of analysis. However, this is not to say that technical analysis is not used by advanced and professional traders. It’s one of the most popular ways to analyse any financial market, by both beginner and professional traders.

Technical analysis relies on three basic premises: (1) history repeats itself, (2) price discounts everything and, (3) markets like to trend. The first point, history repeats itself, is based on the assumption that human psychology doesn’t change over time and that certain price patterns that worked well in the past should continue to work well in the future. The assumption that price discounts everything reflects the thinking that technical traders don’t have to follow market news, as all important market data has already been priced-in by the market. Finally, the third point says that markets like to trend, which is especially true in Forex, where currencies tend to trend for a relatively longer period of time compared to other major financial markets. This makes technical analysis a great way to analyse the Forex market.

When trading Forex from home, there are also a few other tips that can give you a heads up on the market:

1) Use the Asian and Australian session as a gauge for the trading day – If you’re based in Europe, chances are that most of the time you’ll be trading the London and New York session. However, if you analyse the market moves during the Asian and Australian sessions, as well as early in the European session, you can get a feeling of what market participants are thinking about certain currency pairs even before the London session starts. This can give you a notable advantage over other retail traders.

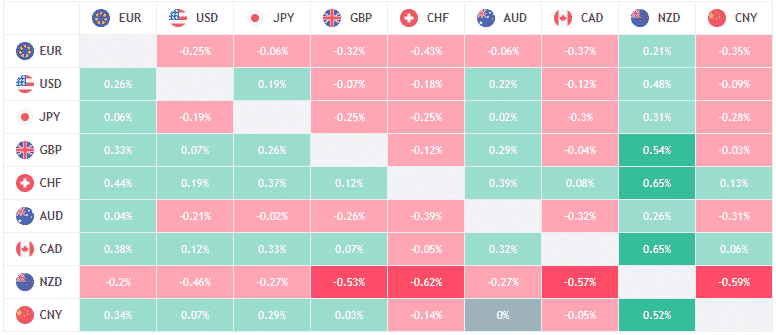

2) Check currency heat maps – Currency heat maps are simple tables that show how a certain currency performs in relation to other major currencies. These heat maps can be a valuable tool to determine how certain groups of currencies perform, such as the US dollar, safe havens, and risk currencies.

3) Don’t overtrade the market – When beginners start trading Forex, they often make the mistake of chasing the market for trade setups, which often leads to overtrading and lost positions. You need to practice disciplined trading and patience early in your trading career. This will help avoid many costly mistakes down the road.

4) Analyse the market the evening before – Once you decide you want to trade Forex, learn how to correctly analyse the market. When I started out, I used to analyse the market in the evening. This is often the quietest time of the day (besides early mornings) where you can fully concentrate on what is happening on the market. Read some Forex news, mark important technical levels on a few charts, and you’re ready to trade the next morning if important events happen.

5) Use pending orders when you’re not in front of your computer – Pending orders are a great and time-efficient way to trade the market. Whenever you see a potential trade setup which has not yet been confirmed, you can place a pending order to trade the upcoming price movement. For this purpose, traders use buy stops, sell stops, buy limit and sell limits, which remain pending until the price reaches a pre-specified level.

While explaining how these orders work would be beyond the scope of this beginner’s guide on how to start trading Forex, it’s enough to know that these orders exist and are part of the MetaTrader trading platform. We’ll cover how they work in a later article.

6) The trend is your friend – While this might be a cliché saying in the trading community, it’s still a great working one. As a beginner, always trade in the direction of the underlying trend. If a trend points up, look only for long entries. And if a trend points down, look to short the market. It’s always easier (and more profitable) to trade in the direction of the trend than to identify a trend reversal or profit on a counter-trend trade.

Final words

In this guide, we covered a fast-track program on how to start trading Forex. Basically, all you need is a computer with internet access, a brokerage account, and a trading platform which you can download from your broker’s website: this is the simplest answer. The somewhat longer answer would be that your computer needs to be fast enough to simultaneously handle multiple tabs in your web browser and to run a trading platform, that your broker should be regulated and offer low transaction costs, and that you need to practice discipline and patience when trading in order to prevent the most common mistakes that beginners make. In addition, by following all the tips on how to trade Forex from home, you’ll have a nice advantage over other beginners. Forex trading involves a lot of learning and many hours of screen time, but in the end it will be worth it.