The Forex market is one of a number of financial markets that offer trading on margin through a Forex margin account. Many traders are attracted to the Forex market because of the relatively high leverage that Forex brokers offer to new traders. But, what are leverage and margin, how are they related, and what do you need to know when trading on margin? This and more will be covered in the following lines.

Margin Forex definition

Trading on margin refers to trading on money borrowed from your broker in order to substantially increase your market exposure. When opening a margin trade, your broker lends you a certain sum of money depending on the leverage ratio used, and allocates a small portion of your trading account as the collateral, or margin for that trade. The remaining funds in your trading account will act as your free margin, which can be used to withstand negative price fluctuations from your existing leveraged positions, or to open new leveraged trades. The relation between your free margin and other important elements of your trading account, such as your balance and equity, will be explained later. For now, it’s important to understand the meaning of margin in Forex.

What does margin mean in Forex trading?

As we've already stated, trading on margin is trading on money borrowed from your broker. Each time you open a trade on margin, your broker automatically allocates the required margin from your existing funds in the trading account in order to back the margin trade. The precise amount of allocated funds depends on the leverage ratio used on your account.

Relation between leverage and Forex margin explained

The first time you open a trading account with a Forex broker, chances are that you’ll see the available leverage ratios which are offered by the broker. Many brokers use leverage ratios for marketing purposes, as higher leverage ratios allow you to open a much larger position size than your trading account would allow.

Popular leverage ratios in Forex trading include 1:10, 1:50, 1:100, 1:200, or even higher. Simply put, the leverage ratio determines the position size you’re allowed to take based on the size of your trading account. For example, a 1:100 leverage allows you to open a position 10 times higher than your trading account size, i.e., if you have $1,000 in your account, you can open a position worth $10,000. Similarly, a leverage ratio of 1:100 allows you to open a position size 100 times larger than your trading account size. With $1,000 in your trading account, you could open a position worth $100,000!

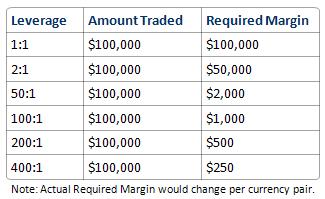

Since the leverage ratio determines the Forex margin requirements, here is a table that showcases the required margins depending on the leverage ratio used.

|

MARGIN REQUIRED |

LEVERAGE RATIO |

|

5.00% |

1:20 |

|

3.00% |

1:33 |

|

2.00% |

1:50 |

|

1.00% |

1:100 |

|

0.50% |

1:200 |

|

0.25% |

1:400 |

As you can see, the higher the leverage ratio used, the less margin you need to allocate for each trade.

Trading on leverage carries risk

You could ask yourself, why wouldn’t you use the highest leverage ratio available in order to decrease your margin requirements and get an extremely high market exposure? The answer is rather simple and deals with Forex risk management. While leverage magnifies your potential profits, it also magnifies your potential losses. Trading on high leverage increases your risk in trading.

Let’s cover this with an example. If you have $1,000 in your trading account and use a leverage of 1:100 you could theoretically open a position size of $100,000. However, by doing so, your entire trading account would be allocated as the required margin for the trade, and even a single price tick against you would lead to a margin call. There would be no free margin to withstand any negative price fluctuation.

Now, let’s say you open a trade worth $50,000 with the same trading account size and leverage ratio. Your required margin for this trade would be $500 (1% of your position size), and your free margin would now also amount to $500. In other words, you could withstand a negative price fluctuation of $500 until your free margin falls to zero and causes a margin call. Your position size of $50,000 could only fall to $49,500 – this would be the largest loss your trading account could withstand.

Margin, free margin, balance, and equity explained

Now that we've defined margin in Forex trading, let’s take a look at the various elements of your trading account and how they are being affected by the leverage ratio and margin requirement. It’s extremely important to understand how these elements are intertwined, in order to create a sound risk management strategy.

Equity – Your equity is simply the total amount of funds you have in your trading account. Your equity will change and float each time you open a new trading position, in such a way that all your unrealised profits and losses will be added to or deducted from your total equity. For example, if your trading account size is $1,000 and your open positions are $50 in profit, your equity will amount to $1,050.

Balance – Your trading account balance equals your equity only if you have no open positions. In other words, unrealised profits and losses do not impact your balance. Only when you close your trades and the unrealised P/L become realized will your trading account balance change.

Margin – As you already know, the amount of margin on your account depends on the size of your open positions and the leverage ratio used. Your broker automatically allocates a certain amount of funds in your trading account as the margin each time you open a leveraged trade.

Free Margin – Your free margin represents your total equity minus any margin used for leveraged trades. For example, if your equity is $1,000 and your used margin is $100, your free margin would amount to $900. Following your free margin is extremely important, as it is used to withstand negative price fluctuations from your open trades and to open new leveraged trades. It’s important to understand that your free margin increases with profitable positions, but decreases with your losing positions. Once the free margin drops to zero or below, your broker will activate the so-called margin call and close all your open positions at the current market rate, in order to prevent your equity from falling below the required margin.

Unrealized P/L – Finally, unrealised profits and losses are all profits and losses made on open positions. They impact both your equity and free margin. Once you close your open positions, unrealized P/L become realised.

The relationship between all mentioned categories of your trading account can be expressed using the following formula:

Equity = Margin + Free Margin OR Equity = Balance + Unrealized Profits/Losses

Monitoring your available margin

Your available margin (free margin) determines the number of negative price fluctuations you can withstand before receiving a margin call. It also impacts the amount of new leveraged trades you’re allowed to take. Monitoring your free margin is therefore very important, as you don’t want this category to drop to zero.

Each time you open a new trade, calculate how much free margin you would need to use if the trade drops to its stop loss level. In other words, if your free margin is currently $500, but your potential losses of a trade are $700 (if the trade hits stop loss), you could be in trouble. In these situations, either close some of your open positions, or decrease your position sizes in order to free up additional free margin.

What are margin calls and how to prevent them

Margin calls are mechanisms put in place by your Forex broker in order to keep your used margin secure. Remember, your used margin is allocated by your broker as the collateral for funds borrowed from your broker. A margin call happens when your free margin falls to zero, and all you have left in your trading account is your used, or required margin. When this happens, your broker will automatically close all open positions at current market rates.

Final words on margin in Forex trading

Trading on margin is extremely popular among retail Forex traders. It allows you to open a much larger position than your initial trading account would otherwise allow, by allocating only a small portion of your trading account as the margin, or collateral for the trade. Trading on margin also carries certain risks, as both your profits and losses are magnified.

If your free margin drops to zero, your broker will send you a margin call in order to protect the used margin on your account. Always monitor your free margin to prevent margin calls from happening, and calculate the potential losses of your trades (depending on their stop-loss levels) to determine their impact on your free margin. With some experience, you’ll find it significantly easier to follow your margin ratio and understand the meaning of margin in Forex trading.