When trading Forex, getting the direction of the trade right is only one side of the coin. Money management is the other side. Even the best trades and the most profitable trading strategies won’t do much if you don’t have strict money management rules in place to protect your winning trades, cut your losses, and grow your trading account. That’s why we’ve covered the 8 things they don’t tell you about Forex trading and money management that you need to know now!

What is money management in Forex?

Money management Forex refers to a set of rules that help you maximise your profits, minimise your losses and grow your trading account. While it’s pretty easy to understand the benefits of these techniques, it happens that beginners to Forex trading tend to neglect even basic money management rules and end up blowing their accounts. Analysing the market and determining whether to go long or short may be difficult enough for beginner traders, which is why I fully understand that thinking about managing your money and risk could seem boring at first.

However, without proper money management you can’t become a profitable trader. Full stop. Let’s take two traders for example – the first trader has an awesome trading strategy that is profitable 90% of the time, but doesn’t manage their risk at all. The second trader has an average trading strategy with a 50% winning rate, but utilises top-notch money management rules. What do you think, which trader will end with more profits by the end of the month? The answer is the second the trader, as the first trader will likely lose all of their profits (and perhaps even more) on a single losing trade. This is why a Forex money management plan helps a lot to succeed in trading.

Enough talking, let’s take a look at some of the most important rules of money management trading Forex.

Forex skills that are important for money management

The following list is not all inclusive and there are many more rules that can be used to manage your trades and money. However, in my experience, these tend to work the best as they directly focus on the most important point – minimising your losses.

Don’t chase the market

The first rule we’re going the cover simply tells us not to chase the market. New traders on the Forex market usually chase the market for trading opportunities and trade even on low-probability trade setups, ultimately ending up with a hefty loss. Excited by the market and their first trading account, beginners will open multiple trades in a single hour, hoping for a great profit by the end of the day. Unfortunately, this behavior resembles more a gambler than a trader.

The market doesn’t owe you anything. With experience, you’ll learn that patience is a key psychological trait that makes a great trader. You don’t have to open a new trade every hour, or even every day. If there are no trading opportunities, I step aside and let the market come to me in the next few days when a high-probability trade setup arises. Never chase the market – even a single losing trade can wipe out much of your previous profits.

Cut the losses short and let the profits run

Another important saying in the trading community is cut the losses short and let the profits run. This refers to a straightforward principle – when a trade is losing, close the trade before the losses accumulate, and when a trade is performing good, leave the trade open and have faith in your trade setup.

Inexperienced traders do it the other way around. They leave losing trades open in the hope that they will eventually reverse, and they close a profitable trade too soon on fears that the trade may turn against them and become a losing one. Fear and greed are one of the most disastrous emotions in trading, and you need to learn how to control them early in your trading career. The most profitable traders do it the professional way – they cut their losers and let their winners run.

Be cautious when trading on leverage

A common mistake among beginners is trading on too much leverage. Leverage is a double-edged sword – it can magnify your profits, as well as your losses. It may be tempting to trade on large leverage and double your trading account every week, but unfortunately this is not how trading works. The main principle that traders need to understand is that capital protection is always first. When opening a trade, think first about the downside risks and how much you could potentially lose, and only then think about the potential profits.

The ideal leverage ratio is determined by a number of factors: your risk-per-trade, your typical stop-loss distance, and your trading account size. We’ll cover those in the following points.

Top Forex money management rules

The following two rules are critical to any Forex trader. Make sure you understand them fully before going on with the remaining points.

Risk-per-trade

Risk-per-trade refers to the maximum amount of risk you’re taking per any single trade. Risk-per-trade is usually determined as a percentage of your trading account size. Let’s say that you have a $10,000 account. If you open a trade with a potential loss of $2,000 (the maximum loss if the trade hits your stop-loss), then your risk-per-trade would be equal to 20%. This example shows how not to trade. Taking a 20% risk-per-trade is way too much risk, as a strike of five losing trades would wipe out your entire account! Even two losing trades would leave you with only 60% of your initial trading account size, and guess what – it takes much more than 40% to return to your initial account size of $10,000. The following table shows how much you need to make to return to your initial account after a series of losses.

|

Amount of balance lost |

Amount necessary to return to initial balance |

|

10% |

11% |

|

25% |

33% |

|

50% |

100% |

|

75% |

400% |

|

90% |

1,000% |

As you can see, losing 90% of your account balance will take a whopping 1,000% growth to return to your initial trading account size. Looking at international Forex tips, the golden rule is to have a risk-per-trade not larger than 2-3% of your trading account size.

Reward-to-risk ratio

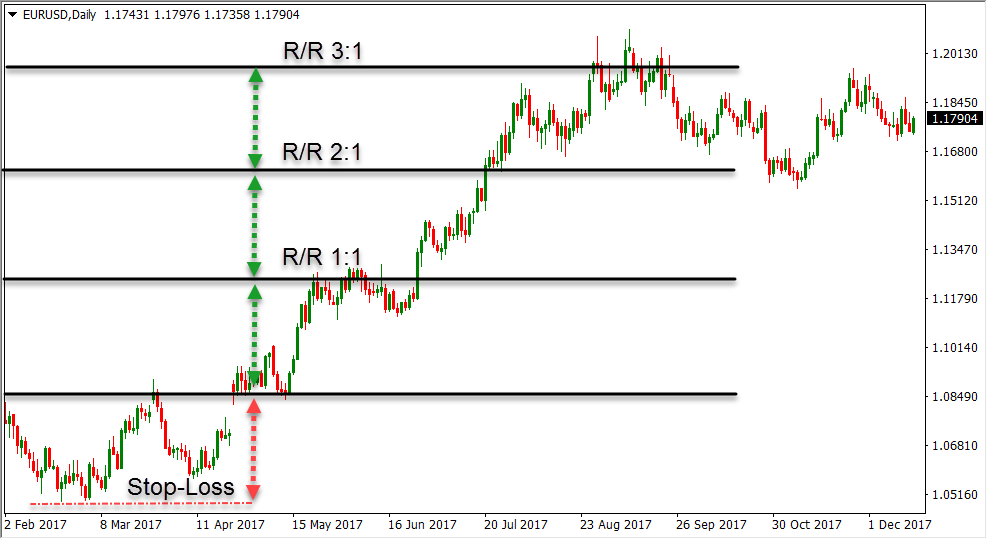

The next important concept in money management is the reward-to-risk ratio, also called the R/R ratio. This refers to the ratio between your maximum loss on a trade, and your maximum profit on a trade. Both categories can be simply determined by your stop-loss and take-profit levels. If your maximum loss on a trade is $100, and your maximum profit is $100, your R/R ratio would be equal to 1. But, if your maximum loss is $100, and your maximum profit $300, your R/R ratio would now be 3.

A large survey made by a Forex broker concluded that traders who have R/R ratios higher than 1 tend to be 30% more profitable than traders with R/R ratios lower than 1. In fact, the best trades are those with R/R ratios of at least 2.

Why is this so important? Let’s say you open six trades, each with an R/R ratio of 1 and identical risk-per-trade. If you manage to have three winning trades and three losing trades out of the total six trades, you’ll make a total of $0. You’ll stay on break-even.

However, if all of the six trades have R/R ratios of 2 (assuming identical risk-per-trades), three losing and three winning trades will now generate a handsome profit, because you’re winning two times more on each winning trade than you’re losing on each losing trade. This is the power of reward-to-risk ratios, making it a crucial part of a well-rounded Forex trading money management system.

Money management techniques in Forex trading

Finally, let’s cover the remaining tips which can have a large impact on your trading performance.

Order types – Market order types can be used to manage your risk and improve your profitability. Consider using stop and limit orders with predetermined stop-loss and take-profit levels to catch breakouts, and start using trailing stops to move your stop-loss with each incoming price tick that goes in your favour. There’s no free Forex money, you need to combine various tools to manage your risk.

Always use stop-losses – Stop-loss orders are an important part of comprehensive Forex investment plans. In this Forex trading presentation, we mentioned stop-losses a few times as integral parts of many MM forex techniques.

Position sizing – Last but not least, position sizing is used by pro-traders to increase their profits in winning trades, and reduce their losses on losing trades. As one of the top Forex money management strategies, position sizing works by opening additional trades in the direction of a winning trade, and closing a part of open trades when a trade is losing.

Final Words – Forex Trading Money Management Strategies

The best Forex money management system needs to be a well-rounded and comprehensive system that utilizes most, if not all rules presented in this article. Money management goes well beyond simple risk management – it’s a complete set of rules that promote account growth and risk minimisation. If you want to learn about this important topic, a Forex money manager license covers all these points and more, and a “Money management in Forex trading pdf” e-book can provide more details on each of the rules.