Your success in Forex trading heavily depends on the tools that you have at disposal. For traders, the main tools come in the form of software, which has all the necessary features needed to analyse the market in real time. Forex software comes in various forms, including trading software, social trading platforms, news aggregators, and even Forex trading programs that are able to trade on their own; called automated Forex trading software.

In this article, we’ll provide a detailed overview of the best Forex trading software available on the market. Feel free to try them out after you’ve read and understood these guidelines. Even the best free Forex trading software can have its drawbacks, which will also be outlined in this article. We’ll also explain how to use Forex trading software and how to install trading robots in your MetaTrader platform.

What is Forex software?

Forex software is computer programs that are used by Forex traders to trade on the market. They can come in various forms, and each of them provides a different tool to traders. When combined together, top Forex trading software is a complete toolbox that allows traders to open positions on the market, analyse it, get a feel for the market sentiment through social trading platforms, find relevant Forex news, and even automatically execute Forex trades without any input from the trader.

Naturally, trading platforms are among the most important Forex programs as they represent the link between you and your broker and provide direct access to the Forex market. Without trading platforms, Forex traders would have a hard time trading on the market. That’s why you should pay special attention when choosing your trading platform, and we’ll soon provide the pros and cons of the market’s most popular trading platforms. But before we get into that, let’s take a look at the main types of Forex software that every trader should know about.

Main types of Forex software

Just like in any other business, Forex software can be grouped according to the tools they provide to Forex traders. In this regard, the main types of Forex software are:

- Trading platforms – As mentioned above, trading platforms are the most crucial Forex programs, allowing you to open, modify, and close trades in the first place. Advanced charting tools and a range of market orders are also important features of a good Forex trading platform.

- Social trading platforms – As the name suggests, social trading platforms add a new, social dimension to Forex trading. Most of them allow you to follow other traders’ trades or to chat with them to get an idea of market sentiment, which can help you with your personal trading.

- Automated Forex trading programs – These are small programs that are usually run inside your trading platform. They analyse the market and make independent trading decisions. This means that no input is needed from your side; automated trading programs will open and manage the positions for you. While this sounds attractive at first, we’ll cover the main risks of this trading approach later on.

Trading platforms

Trading platforms are by far the most important pieces of Forex trading software. As a Forex trader, you’ll probably spend most hours on your trading platform analysing the market and making trading decisions, so choosing a user-friendly and reliable trading platform is a must. In addition, trading platforms need to offer advanced charting tools, different types of market orders, and real-time price quotes to allow for prudent trading decisions.

MetaTrader 4

Launched in 2005, MetaTrader 4 remains to this day the most popular trading platform among retail Forex traders. It has a simple and effective interface combined with advanced trading tools that can have a large impact on your trading performance. Since it has back testing and market simulation capabilities, MetaTrader 4 can also be used as Forex training software, which can prove extremely useful to traders without much experience. The typical user interface of MetaTrader 4 is shown in the following picture.

MetaTrader 4 has a large online community, so you can participate in online forums and ask for support whenever you have some questions about the trading platform. This large community has also developed hundreds of automated trading programs for MT4 – called Expert Advisors – which you can often download for free and use in your daily trading.

MetaTrader 5 – The Successor of MT4

MetaTrader 5 is the successor of MetaTrader 4 and features many upgraded tools compared to its older cousin. The new platform now includes a greater variety of graphical objects and timeframes, which is especially important to day traders who mostly rely on technical analysis in their trading. Aside from the standard market orders of MetaTrader 4 (stop and limit orders), MetaTrader 5 now also includes a combination of the two, called Stop Limit orders. More market orders allow for a greater variety of trading strategies that you can use to trade the market.

Last, but not least, MetaTrader 5 comes with an improved Strategy Tester and a built-in economic calendar. This helps with keeping up to date with the ever-changing Forex market and macroeconomic indicators, which often have a significant impact on exchange rates.

Social trading platforms

A relatively new phenomenon in the sphere of online Forex trading software is social trading platforms. Forex traders can use social trading platforms to take the market’s pulse as it were, by assessing the sentiment of other market participants. Many social trading platforms show a list of trades that other traders have made during the day, which can be a handy tool to quickly scan what other traders are thinking about certain currency pairs.

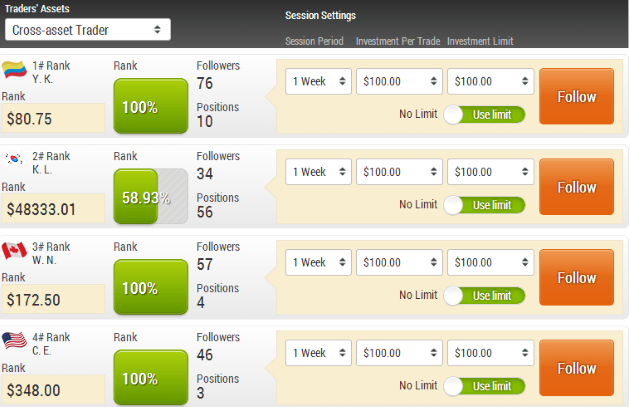

Some social trading platforms even allow for copy trading, which means that you choose a trader with a successful track record and simply copy their trades onto your trading account. However, be aware that past results are not indicative of future performance, and even traders with stellar track records can have a bad month here and there. This is why we advise using social trading platforms only as a tool to get a feel for market sentiment and discuss potential trades with other Forex traders. A typical social trading platform with copy trading features is shown in the following picture.

If you’re looking for a social experience in trading, social trading platforms may be one of the best pieces of software for this purpose. However, bear in mind that the majority of online market participants can be on the wrong side of the trade, so make sure that you always question the analysis you find on social trading platforms and avoid following trade recommendations blindly.

Automated Forex trading software

Finally, let’s discuss what automated Forex trading is and how it ranks in our Forex trading software comparison. Automated Forex trading programs rely on short lines of code that are executed within your trading platform, such as MetaTrader 4 or 5. These programs analyse the market and make independent buy and sell decisions on certain currency pairs. This means that no input is required from you, the trader. Everything is done automatically, from the analysis, to opening, managing, and closing the positions. This approach eliminates emotional trading, which is a major hurdle for new Forex traders in becoming successful.

Although this may seem very attractive, be aware that automated trading programs also have their risks. For example, most of them are based on technical trading rules that work well under certain market conditions, such as in trending markets, but fail to generate profits when market conditions change. Additionally, simple technical rules such as moving average crossovers don’t take the bigger picture of the market into account, and can stop working from time to time even if market conditions don’t change.

MetaTrader 4 has a large online database of automated trading programs that you’re free to download and try. However, we would advise all traders to focus on building their own trading skills over time and not to rely on trading robots in their work.

How does automated Forex trading software work?

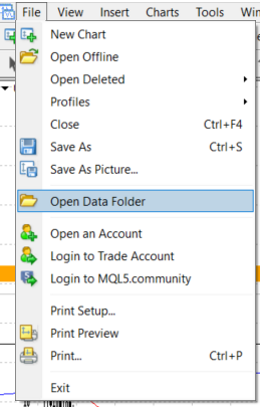

As mentioned earlier, automated Forex trading programs are executed inside your trading platform. This means that you have to download the trading robot to your computer (for MetaTrader 4, its extension is *.ex4), and place it into the “Experts” folder of your MetaTrader installation. To find the “Experts” folder, simply open the trading platform, click on File -> Open Data Folder, select “MQL4” and then “Experts”.

Copy and paste your trading robot into the folder and restart your trading platform. Done! Your automated trading robot is now installed on your MetaTrader 4 platform.

To execute it, click on “Expert Advisors” in the MT4 Navigator tab and drag and drop the desired trading robot to your price chart. Alternatively, you can also right click on the Expert Advisor and select “Attach to a chart”.

Expert Advisors for MetaTrader are programmed in a special programming language called MetaQuotes. The syntax pretty much resembles that of the programming language C, so if you have a programming background, you could develop your own trading robot with little experience. However, be aware that trading robots coded for MetaTrader 4 won’t work on MetaTrader 5, and vice-versa.

Risks of automated Forex trading programs

While some risks associated with trading robots have already been mentioned above, there are some more that need explaining. Many trading robots rely on technical indicators to make their trading decisions. Technical indicators use historical price data for their calculations, all of which “lags” the price quite a bit. In other words, a technical indicator will trigger a buy or sell signal only after the initial price movement has occurred, so you’ll miss out on those early profits.

That being said, trend-following trading robots can indeed generate profits by simply following the underlying trend. However, be aware that many false signals and losing trades will likely happen once the market environment changes from trending to ranging.

Always back test automated trading programs

We can’t overstate the importance of back testing any manual or automatic trading strategy. While manual back testing can be quite time consuming, trading robots can fortunately be back tested pretty quickly with MetaTrader’s built-in Strategy Tester, which makes it one of the best pieces of Forex trading software around.

All you need to do is to open your trading platform, press the keyboard shortcut CTRL+R, which opens the Strategy Tester, select the trading robot you want to back test, select the currency pair and time period, and click “Start”. This will generate a detailed report of the trading robot’s performance, including gross profit/loss, opened trades, profit/loss per trade, number of winning trades, number of losing trades etc. Only after you back test a number of trading robots should you pick one and try it on your live account.

Conclusion

This Forex software comparison tried to provide a comprehensive overview of the major types of Forex trading software that are available on the market. There’s no clear answer as to what the best Forex program on the market is. The best Forex software obviously depends on your personal trading needs and goals.

Trading platforms play a crucial role in any trader’s success, which places them among the most important pieces of Forex market trading software. Whether you go for MetaTrader 4, MetaTrader 5 or any other platform, make sure that it is user-friendly, robust, and features advanced charting tools and a range of market orders. A large online community is also extremely helpful in case you need any type of support for your trading platform.

Social trading platforms are also free Forex trading programs which can help in assessing the current market sentiment among retail traders and in finding trading ideas from other successful traders.

Finally, trading robots use technical trading rules to automatically open, manage, and close the positions for you. Be sure to back test a number of trading robots under various market conditions before you decide to apply one on your live account. This will prevent costly trading mistakes down the road.