Not all financial markets are the same. Knowing the main characteristics of each market can help you choose on which market to focus your efforts if you’re just starting out with trading. The pros and cons of each market can impact the daily routine and also the performance of a trader in the long run, so make sure you understand the main differences of Forex compared to the stock market outlined in this article before deciding whether to trade Forex or stocks. Let’s start our Forex vs equities battle!

Forex trading or stock trading: a comparison

1 – Trading times and open market hours

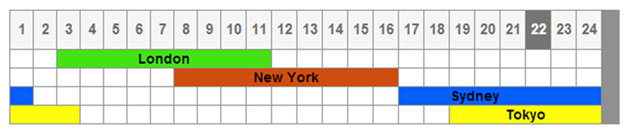

One of the most important differences between stock and Forex trading relates to the trading hours of the markets. Forex is an OTC (over-the-counter) market, which means that currencies can be traded around the clock during Forex trading sessions. The main trading sessions in the Forex market include the New York session, the London session, the Tokyo session, and the Sydney session. The Forex market is closed only during weekends, but the difference in time zones between the mentioned trading sessions makes it possible to trade currencies even in the midnight hours should you choose.

The stock market, on the other hand, sticks to the open market hours of a stock exchange. Most stock exchanges are open from 8am to 5pm local time, making it impossible to trade stocks outside these hours. When a trading opportunity on the stock market occurs after the market closes, you need to wait for the stock market to open the next morning to place your trade. This is the first point for Forex in our trading equities vs Forex battle.

2 – Tradeable instruments

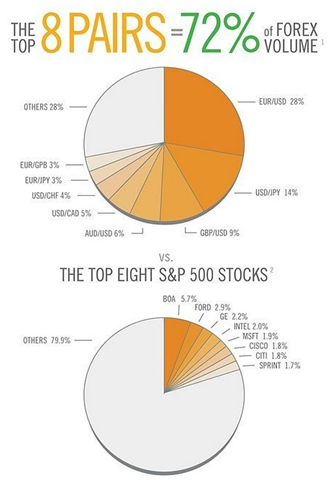

Next on the list of major differences between Forex and stocks is the number of tradeable instruments. There are only eight major currencies on Forex: the US dollar, the euro, the British pound, the Swiss franc, the Japanese yen, the Canadian dollar, the Australian dollar, and the New Zealand dollar. Even if we expand this list to cover all G10 currencies, including the Norwegian and Swedish krona, there are still significantly fewer currencies on the Forex market compared to the stock market. This means traders can focus on a few currencies instead of hundreds of stocks.

The New York Stock Exchange alone has around 2,000 stocks listed. Obviously, it’s far easier to follow a few currencies compared to dozens of hundreds of stocks. While stock traders in this case could have more trading opportunities as they have more instruments at their disposal, it’s almost impossible to keep track of so many stocks at the same time. That’s why stock traders focus on entire industries instead, such as the car industry or tech, and look for trade setups in selected stocks.

3 – Commissions and transaction costs – Forex or stocks for beginners

The growing competition between Forex brokers has reduced transaction costs to record lows. To open a position on Forex, you’ll have to pay the so-called spread, which represents the difference between the buying and selling rate of a currency pair. Major currencies, like the one listed above, are usually very tight spreads in the range of 1-3 pips (the fourth decimal place of an exchange rate), while less liquid pairs and exotic currencies can have significantly higher spreads. However, major currencies are the most traded currencies on the Forex market, and if you’re new to trading you’ll probably focus only on them.

To put the spread into perspective, if you’re trading 100,000 units of the base currency (one standard lot), you’ll usually have to pay around $10 of transaction costs on the EUR/USD pair if your broker’s spread is 1 pip. If you open one mini lot (10,000 units of the base currency), your transaction cost will equal to only $1. With most brokers, there are no commission fees involved in Forex trading.

The stock market, on the other hand, has substantially higher transaction costs compared to Forex. Brokers usually charge a fixed commission to open a trade. However, if you’re trading CFDs on stocks, your transaction costs would be significantly lower and comparable to Forex trading. Still, a stock day trader vs Forex trader could pay way more in transaction costs.

4 – Insider trading

Let’s continue with our comparison of Forex vs stocks. If you have been following the stock market in recent years, you might have noticed insider trading making headlines in the news. Although this practice is forbidden, the large number of listed companies makes insider trading possible. There’ll always be a group of people who know something that the ordinary retail trader doesn’t, whether it’s the financial standing of a company, plans for a new product line, or pending changes in the top management.

How Big is Forex Compared to Stock Exchanges? Large Enough to Withstand Insider Trading.

The Forex market, the largest financial market in the world with an average daily turnover of around $5 trillion, makes insider trading almost impossible. While there is no such thing as a “Forex stock”, currencies are for countries what stocks are for companies. Forex, stocks, and currencies all behave differently due to the size and liquidity of their respective market.

Even if someone knows about some important news in advance, the size and liquidity of the market is able to absorb any buying or selling pressure that could arise from insider trading. Exchange rates of liquid major currency pairs would probably not be impacted at all, which puts the retail Forex trader into an advantageous position compared to their stock trading peer. Another point for Forex in the Forex market vs stock market battle.

5 – The existence of middlemen in trading

Another important difference between stock trading and Forex trading is the existence/absence of an intermediary. As an over-the-counter market, there is no centralised exchange in the Forex market and currencies are exchanged directly between buyers and sellers. Your broker is the only intermediary, making the transaction possible by routing, buying ,and selling orders to match the best possible prices on the market.

If you want to buy or sell stocks on the stock exchange, you can’t bypass an intermediary if you want to make the transaction happen.

6 – The access to leverage – Forex vs stock risks

Exchange rates usually fluctuate less than one percent a day. For retail Forex traders to make a profit on the market, brokers lend them money to open a significantly larger position size than their initial trading account sizes would otherwise allow. This is called trading on leverage.

To open a leveraged position, you have to allocate a small portion of your trading account as the collateral for the position. The available leverage on the Forex market is extremely high – much larger than on the stock market. Forex brokers offer 100:1, 200:1 or even 400:1 leverages, while the stock market is usually restricted with a maximum leverage of 20:1. This is a clear point for Forex in our stock market vs Forex battle.

However, trading on extremely high leverage can also lead to large losses if your analysis shows to be incorrect. Leverage increases both your profits and losses, so make sure you fully understand the concept of leverage and the risks associated with it before trading on high leverage ratios.

7 – Technical analysis for Forex and stocks

Technical analysis is an analytical discipline that involves the analysis of pure price charts. Since one of the basic tenets of technical analysis is that markets like to trend, almost all technical tools are primarily aimed at identifying trends and trend reversals in their early stages.

It’s no secret that trend-following strategies are very profitable. Think about it: you only have to catch a trend early in its development, open a position in the direction of the trend, and ride it as long as it lasts.

The Forex market is famous for its long-lasting trends. Currencies simply like to trend, as they’re influenced by a number of fundamental factors that gradually build up over time leading to strong trends in the long-term. That’s why technical analysis works great on the Forex market, and many retail traders base their trading decisions solely on technical levels.

Technical analysis also works on the stock market. Tools such as chart patterns, moving averages, and trend lines are regularly used by technical stock traders to find profitable trading opportunities, so it’s a draw in this round of our Forex vs stock exchange battle.

Which is better – Forex or stock market trading?

The final question still remains: should you trade Forex or the stock market? In this article, we shed some light on the main difference between Forex and the stock exchange to make your decision easier on which market to focus. There’re actually many traders who trade both the Forex and the stock market quite successfully. However, when talking about Forex vs stock market trading, Forex has a significant advantage with regard to trading times, leverage, absence of insider trading, and intermediaries, and the lower number of currencies compared with stocks makes it easier for beginners to analyse and follow the market. So, if you’re asking whether you should trade Forex or stocks as a beginner and is Forex better to trade than equities, think about starting with Forex first.

So, which is better, Forex or equity? Both Forex and stocks have their own advantages and disadvantages, so if you still don’t feel confident about which market to choose, try to trade both and draw your own conclusions.